Would you like to know more about the industrial bakery products distribution networks ? Do you want to learn more about the journey of a piece of bread, viennoiserie or pastry from the factory to our plate ?

Feel free to consult the overview of products from the baking industry in addition to this article to gain a comprehensive understanding.

To begin with, it is important to mention some key figures about the bakery industry. Its estimated revenue is approximately €15 to €16 billion, depending on the sources. The baking industry sector accounts for about half of this, approximately €8 billion, with the rest coming from artisanal activities.

Export / French market

This is a dynamic sector in terms of exports!

While the ratio remains modest compared to the portion intended for the domestic market (around 20%, approximately €1.5/€1.6 billion), the trend is extremely interesting. In fact, if we go back to the early 2000s, exports only reached around €500 million, which is three to four times less than today.

The product mix has also evolved significantly over the past 20 years. Historically, bakery industry products destined for foreign markets consisted mainly of bread, including a range of white bread products and higher-quality artisanal bread with pointy dough. These products were typically sold raw or partially baked and mostly frozen. Today, the situation is completely reversed. Viennoiserie is the flagship export product of the baking industry. This range primarily consists of croissants, in both traditional and mini formats, available frozen, raw, or pre-proofed. Viennoiserie have accounted for between 70% and 80% of the baking industry product volume in recent years and have generated between €1 billion and €1.3 billion in revenue.

So where do these baking industry products go around the world ?

Firstly, to our European neighbors, who have a fairly significant baking industry sector but face capacity constraints that force them to import products from France. Our neighboring countries also choose French bakery products for their origin, diversity, and quality. Here are the top importing neighboring countries, in order of importance: the United Kingdom, Germany, Belgium, and Italy. These four countries represent three-quarters of France’s overall exports.

The remaining quarter is exported to the wider global market. Three main regions make up the majority of these destinations: North America, including the USA and Canada; Asia, primarily China; and Australia.

Domestic market

By deduction, the share of the domestic market for baking industry products is estimated to be between €6.4 billion and €6.5 billion. There are various distribution channels within the country, offering diversity, varying economic significance, and, much like the industrial sector itself, constant evolution.

1 - Supermarkets chains and stores

Undoubtedly, these are the heavyweight champions of baking industry product distribution channels. They dominate in terms of market share (50-55%, approximately €3.4 billion) and also offer a wide variety of referenced product mixes (the entire range of the baking industry products is represented on their shelves, either as private label or own-brand products). This distribution channel consistently benefits from the advantage of being able to move substantial production volumes, albeit at the expense of narrower profit margins.

2 - Catering

The flagship product in this sector is individually packaged pre-cooked bread. It is easy to reheat and adapts well to various formats and needs. Pastry and snack products are becoming increasingly important and are competing with the main dishes offered by institutional catering groups. This segment remains a significant channel for the baking industry, accounting for 20% of the market (€1.3 billion).

3 - Hotels and restaurants

This distribution network is on the rise, driven by the hotel industry and the popularity of continental breakfasts, which prominently feature baking industry products (to learn more, see the analysis of baking industry products consumed at breakfast). The bread segment in the restaurant industry is also boosted by a range of “premium” products that meet both the practical needs of restaurateurs and the quality and taste preferences of customers. Fast-food chains also contribute to the baking industry by sourcing not only from specialized industrial producers of buns but also from others due to increasing demand for products such as American pastries. This sector accounts for 5% to 7% of the market (€390 million).

4 - Artisan & Craft bakeries

Craft bakeries are significant consumers of baking industry products. The law, as defined in Article L 121-80, modified to L 122-17 by Order 2016-301 of March 14, 2016, sets the rules for bread and prohibits the use of the bakery sign for “professionals who do not themselves perform… kneading, fermentation, and shaping… on the sales premises…”. However, this leaves room for other products: viennoiseries and pastries, finished or semi-finished, which can come from the industrial sector without the requirement of being produced in an artisanal bakery. Historically, viennoiseries have been the most consumed products in this sector due to the difficulty in finding skilled labor for their production and the excellent quality-to-price ratio of these products. However, our consumption patterns are changing, and pastries and tartlets, finished or semi-finished, are now complemented by American pastry and snack products. The market share of this sector is estimated to be 8% to 10%, or approximately €580 million.

5 - Bake-off outlets, Franchised sales points and Chain stores

This is a sector that, much like the baking industry sector, is dynamic, innovative, and experiencing growth.

Although this distribution channel remains inconspicuous compared to GMS (8% to 10% market share, €580 million), it is genuinely interesting to delve into.

Firstly, due to its growth, as even though the sector is progressing modestly (2% to 4%), some brands continue their penetration strategy in cities, town centers, and high-traffic locations (train stations and airports), with new store creation rates exceeding 20%. This is in contrast to other brands that are reducing the number of sales locations and strategically retreating to specific well-targeted areas.

Furthermore, the choice to diversify their offerings by providing a wide range of products in the snacking, sandwich, tartlet, and dessert categories, rather than just a selection of bread, undoubtedly strengthens their appeal and profitability.

There are two types of sales points: bake-off outlets that only involve reheating products through proofing, baking, and/or display, and sales points that combine a similar activity with the additional production of products, either limited to bread or more broadly encompassing pastries and snacks.

This sector is also distinctive due to its interconnection with the bakery industry. Many brands of sales points and outlets belong to milling and/or baking industry industrial groups, which allows them to have a dedicated distribution channel for their finished or semi-finished products. What’s extremely interesting is the analysis of this supply chain organization carried out by major national players across the entire territory, as well as by regional industrial players at the local level.

The list is long, but nationally recognized brands include La Brioche Dorée, Paul, La Mie Câline, Les Fromentiers, Le Fournil de Pierre, or Boulangerie Louise, which are owned by leading French baking industry industrial players. Brands like Boulangerie Ange, Marie Blachère, La Croissanterie, Patàpain, and Boulangerie Feuilette belong to groups and operating companies. Brands like Chevallier, Sophie Lebreuilly, L’Atelier Papilles, Les Fournils de France, and La Panetière are local and national franchise networks. Finally, Banette, Festival des Pains, and La Ronde des Pains are retail concepts operated by industrial players in the milling/baking industry. In addition, there are countless independent retailers throughout France selling baking industry products through their own sales points every day.

In conclusion...

With numerous distribution channels, a significant emphasis on the supermarket business, a thriving export market, and the presence of industry leaders from production to sales points, this is the current distribution landscape for bakery industry products. This situation is expected to evolve in the coming years, as the baking industry is known for its innovation, creativity, and constant movement.

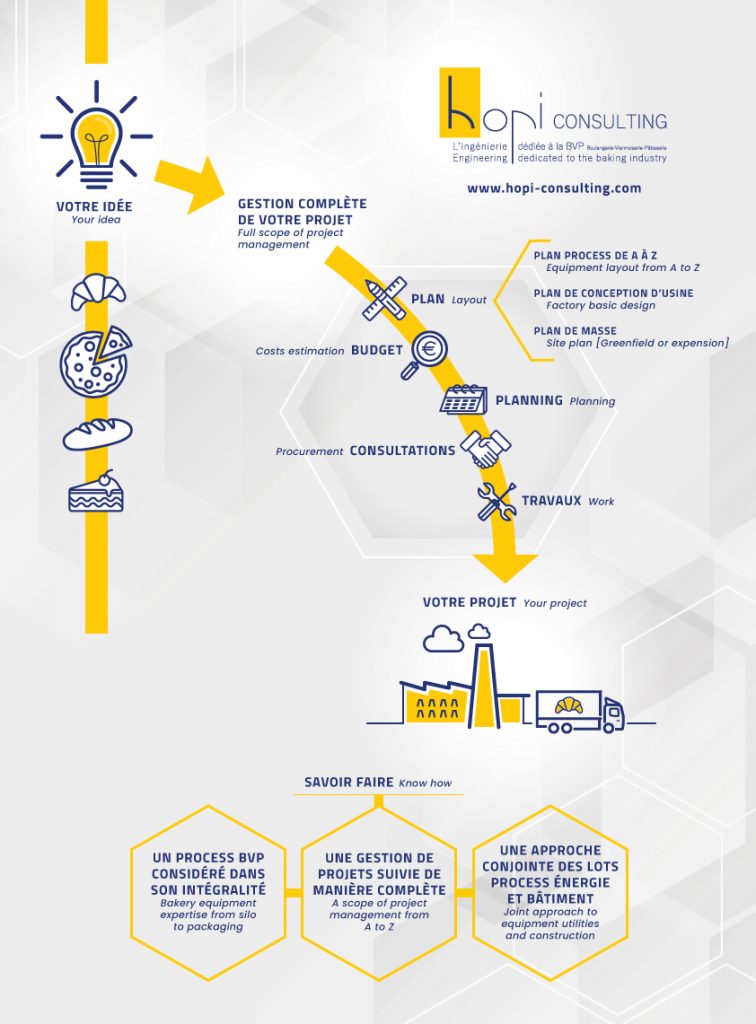

This article was written by Hopi Consulting, an engineering company dedicated to Bakery, Viennoiserie and Pastry. Explore more articles about the Baking Industry on the Hopi blog.

Sources :

Thanks to my clients for their contributions and shared figures.

Fédération des entreprises de la boulangerie. (2018 Activity report).

UNIGRAINS&LIMAGRAIN_CONF_JTIC_2015_VERSION COMPLETE FINALE.

And my exchanges with everyone on a daily basis.